Publicly traded companies are outpacing US spot Bitcoin ETFs in BTC accumulation this year, according to newly compiled data from crypto platform CEX.IO.

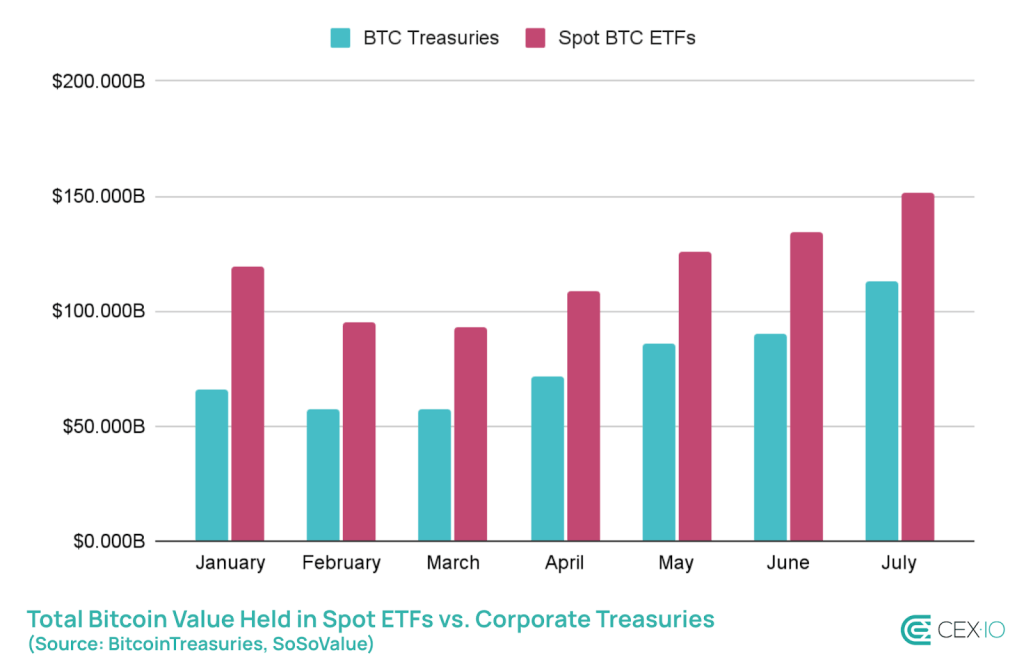

Earlier this year, US spot Bitcoin ETFs controlled nearly $120 billion in assets, almost double the $65.8 billion held by public companies. However, corporate treasuries have since ramped up their Bitcoin purchases, narrowing the gap significantly.

Data from CEX.IO shows a 96% increase in corporate BTC holdings so far this year, compared to a 44% rise among ETFs. In dollar terms, public firms added $47.3 billion worth of Bitcoin to their reserves in 2025, surpassing the $31.7 billion in net inflows recorded by ETFs.

One of the most active buyers this year is Strategy, the firm formerly known as MicroStrategy. Since January, Strategy has increased its Bitcoin exposure by over $12 billion to reinforce its long-standing position as a corporate leader in BTC accumulation.

Another notable player is Twenty One Capital, a digital asset firm backed by Cantor Fitzgerald, Tether, and SoftBank. Its Bitcoin holdings have climbed above $5 billion, reflecting the strong institutional interest in direct BTC ownership.

Meanwhile, Japanese firm Metaplanet has multiplied its BTC stash nearly sixfold this year to more than 17,000 BTC.

The rising influence of corporate treasuries in the Bitcoin market signals more than just portfolio diversification. Unlike ETFs, which offer liquid, custodial exposure, balance sheet holdings reflect a direct and less flexible commitment, often tied to long-term strategic views.

The post Public companies outpace ETF buying with $47B in Bitcoin added this year appeared first on CryptoSlate.